September 28, 2020 – Vancouver, B.C. – Solaris Resources Inc. (TSXV: SLS) ("Solaris" or the "Company") is pleased to report assay results for the second and third drill holes from the ongoing 40,000 metre (m) diamond drill program at its Warintza Project (“Warintza” or “the Project”) in south-eastern Ecuador. The drill program aims to expand the lateral footprint and depth extent of the high-grade Warintza Central zone, discovered by the late David Lowell in 2000.

Highlights from the recent drilling are listed below and summarized in Table 1 and 2.

Highlights

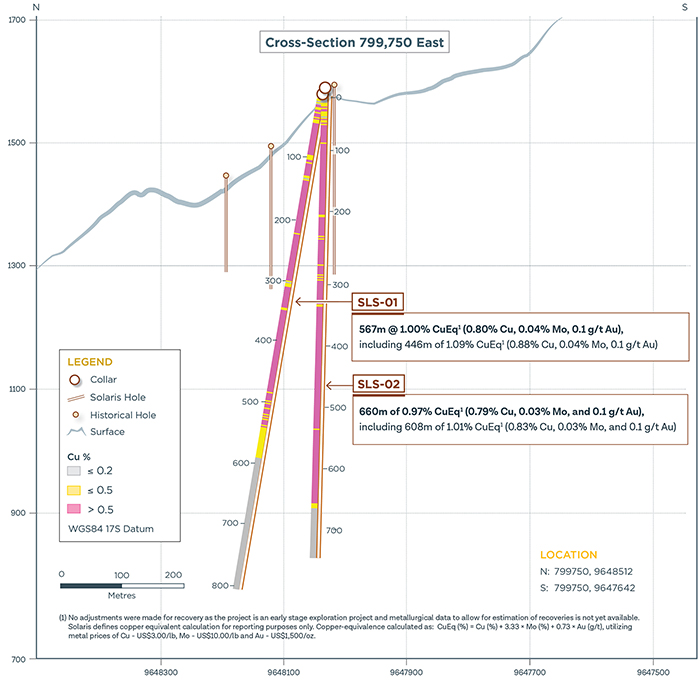

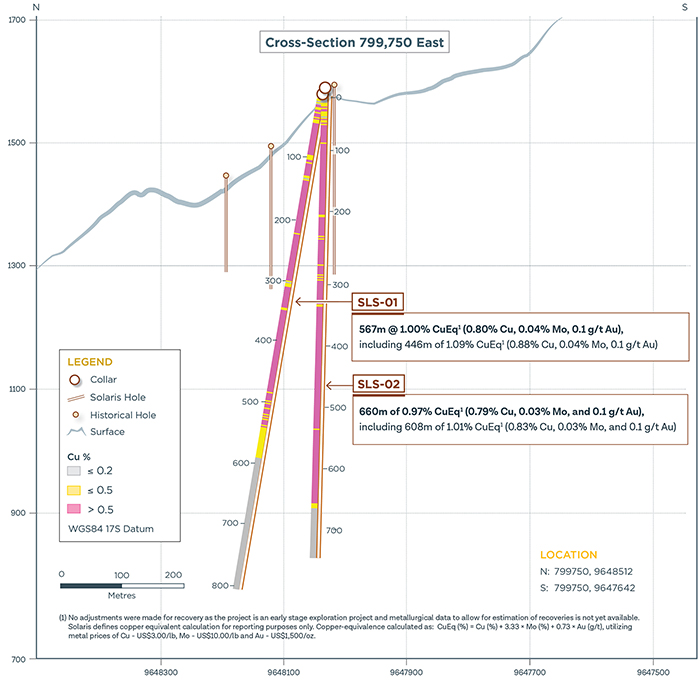

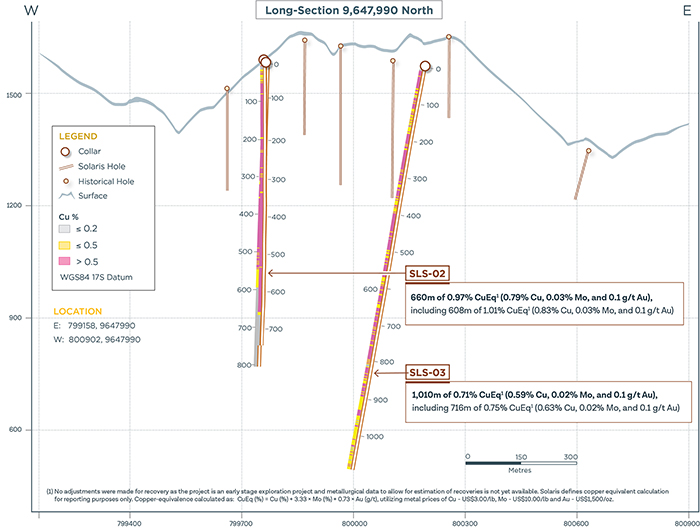

- SLS-02 returned a consistent, high grade interval from surface of 660m of 0.97% CuEq¹ (0.79% Cu, 0.03% Mo, and 0.1 g/t Au), confirming the significant extension of mineralization relative to historical drilling first reported in SLS-01 (see August 10, 2020 Press Release)

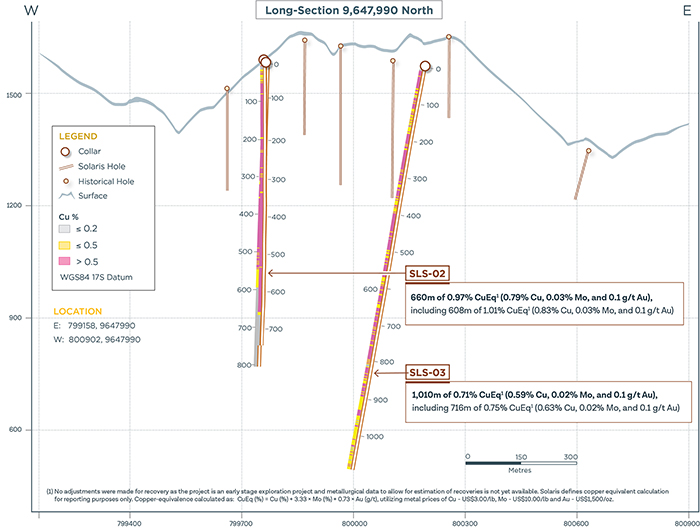

- SLS-03 returned a much longer and open interval of high-grade mineralization from surface to the depth capacity of the drill rig: 1,010m of 0.71% CuEq¹ (0.59% Cu, 0.02% Mo, and 0.1 g/t Au), including 716m of 0.75% CuEq¹ (0.63% Cu, 0.02% Mo, and 0.1 g/t Au)

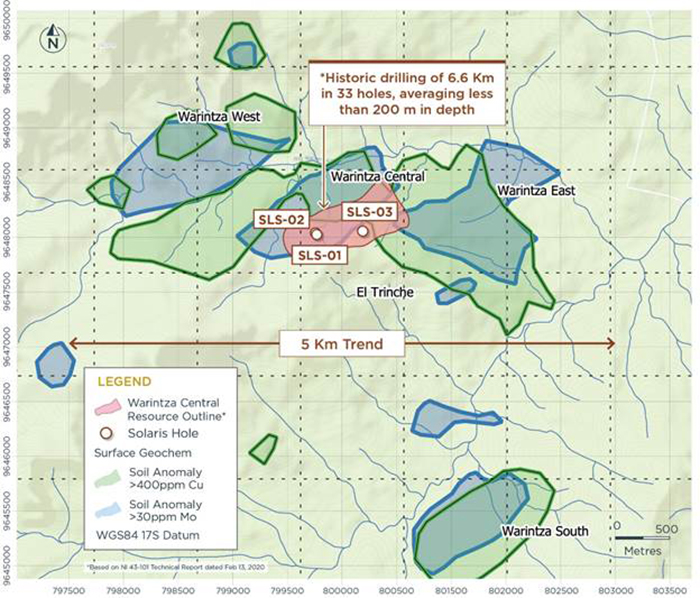

- SLS-03 was collared approximately 426m east of the first two holes and greatly improves upon the depth extent of known mineralization, with historical drilling averaging less than 200m in depth (see Images 1 & 2)

- Geological interpretation suggests that the mineralization encountered to date is representative of the ‘outer halo’ of the porphyry system, with the higher-grade core to be vectored toward with future drilling locations

- The first three holes were drilled with one rig; drilling is now ongoing with two rigs and a third rig with greater drilling capacity is due imminently

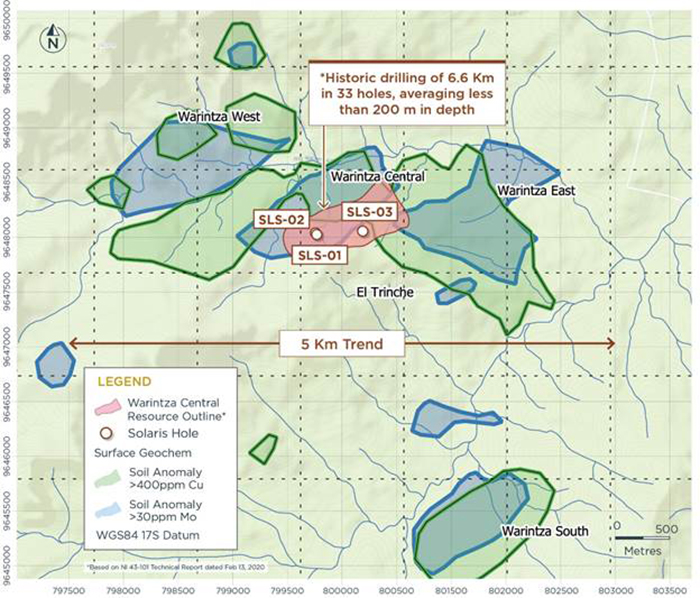

Mr. Jorge Fierro, Vice President, Exploration, commented, “The third hole stepped out over 400m to the east of the first drilling location within Warintza Central (see Image 3) and provided further evidence of the depth extent of the system, which still remains open. In addition, the results continue to support our interpretation that our drilling is confined to the ‘outer halo’ of the porphyry system. Additional drilling locations will be required to triangulate the high-grade core.”

Mr. Richard Warke, Executive Chairman, commented, “Warintza Central continues to demonstrate the potential to become a large, high-grade open pit copper porphyry deposit, which is a rarity in the modern context of the industry. As strong as results are, what’s extremely exciting is that we are at a very early stage of exploration on the property and drilling has only occurred at Warintza Central. The trend is 5km long and includes Warintza East, West and South, all of which are approximately of equal footprint and West and South have yielded higher soil and chip samples.”

Warintza Central is presently defined by a pit-optimized Mineral Resource estimate of 124 Million tonnes of Inferred Resources grading 0.70% CuEq² (0.56% Cu, 0.03% Mo and 0.1 g/t Au), based on historic drilling totaling less than 7,000m and averaging less than 200m in depth. The resource is entirely open laterally and at depth and is set within the 5 km-long Warintza trend of porphyry mineralization. There has been no drilling outside of the Warintza Central area.

Table 1

| Drill Hole |

From (m) |

To (m) |

Interval (m) |

Cu (%) |

Mo (%) |

Au (g/t) |

CuEq³ (%) |

| SLS-02 |

0 |

660 |

660 |

0.79 |

0.03 |

0.1 |

0.97 |

| Including |

48 |

656 |

608 |

0.83 |

0.03 |

0.1 |

1.01 |

| SLS-03 |

4 |

1014 |

1010 |

0.59 |

0.02 |

0.1 |

0.71 |

| Including |

4 |

892 |

888 |

0.61 |

0.02 |

0.1 |

0.73 |

| Including |

176 |

892 |

716 |

0.63 |

0.02 |

0.1 |

0.75 |

| Grades are uncut and true widths have not been determined. |

Table 2

| Drill Hole |

Datum |

Easting |

Northing |

Elevation (m) |

Depth

(m) |

Azimuth (degrees) |

Dip (degrees) |

| SLS-02 |

WGS84 17S |

799765 |

9648033 |

1571 |

744 |

0 |

-90 |

| SLS-03 |

WGS84 17S |

800191 |

9648059 |

1570 |

1090 |

289 |

-79 |

Image 1

Image 2

Image 3

Technical Information and Quality Control & Quality Assurance

Sample assay results have been independently monitored through a quality control/quality assurance (“QA/QC”) program that includes the insertion of blind certified reference materials (standards), blanks and field duplicate samples. Logging and sampling are completed at a secured Company facility located in Quito, Ecuador. Drill core is cut in half on site and samples are securely transported to ALS Labs in Quito. Sample pulps are sent to ALS Labs in Lima, Peru and Vancouver, Canada for analysis. Total copper and

molybdenum contents are determined by four-acid digestion with AAS finish. Gold is determined by fire assay of a 30-gram charge. ALS Labs is independent from Solaris. In addition, selected pulp check samples are sent to Bureau Veritas lab in Lima, Peru. Solaris is not aware of any drilling, sampling, recovery or other factors that could materially affect the accuracy or reliability of the data referred to herein.

Qualified Person

The technical content of this release has been compiled, reviewed and approved by Jorge Fierro, M.Sc., DIC, PG, Vice President Exploration of Solaris who is a “Qualified Person” as defined in National Instrument 43-101 Standards of Disclosure for Mineral Projects. All technical information related to Warintza is based on the “Resource Estimate of the Warintza Central Cu-Mo Porphyry Deposit" prepared by Equity Exploration Consultants Inc. with an effective date of December 13, 2019 and available on the Company website.

The TSX Venture Exchange does not accept responsibility for the adequacy or accuracy of this release.

On behalf of the Board of Solaris Resources Inc.

“Daniel Earle”

President & CEO, Director

For Further Information

Jacqueline Wagenaar, VP Investor Relations

Direct: 416-366-5678 Ext. 203

Email: jwagenaar@solarisresources.com

About Solaris Resources Inc.

Solaris is advancing a portfolio of copper and gold assets in the Americas, which includes: a high-grade resource with expansion and additional discovery potential at the Warintza copper and gold project in Ecuador; discovery potential on the grass-roots Tamarugo project in Chile and Capricho and Paco Orco projects in Peru; exposure to US$130M spending / 5-yrs through a farm-out agreement with Freeport-McMoRan on the Ricardo Project in Chile; and significant leverage to increasing copper prices through the 60%-interest in the development-stage La Verde joint-venture project with Teck Resources in Mexico.

Cautionary Notes and Forward-looking Statements

This document contains certain forward-looking information and forward-looking statements within the meaning of applicable securities legislation (collectively "forward-looking statements”). The use of the words "intention”, "will”, "may”, "can”, "expect” and similar expressions are intended to identify forward-looking statements. Although Solaris believes that the expectations reflected in such forward-looking statements and/or information are reasonable, undue reliance should not be placed on forward-looking statements since Solaris can give no assurance that such expectations will prove to be correct. These statements involve known and unknown risks, uncertainties and other factors that may cause actual results or events to differ materially from those anticipated in such forward-looking statements, including the risks, uncertainties and other factors identified in the latest Solaris Management’s Discussion and Analysis available at www.sedar.com. Furthermore, the forward-looking statements contained in this news release are made as at the date of this news release and Solaris does not undertake any obligations to publicly update and/or revise any of the included forward-looking statements, whether as a result of additional information, future events and/or otherwise, except as may be required by applicable securities laws.

(1) No adjustments were made for recovery as the project is an early stage exploration project and metallurgical data to allow for estimation of recoveries is not yet available. Solaris defines copper equivalent calculation for reporting purposes only. Copper-equivalence calculated as: CuEq (%) = Cu (%) + 3.33 × Mo (%) + 0.73 × Au (g/t), utilizing metal prices of Cu - US$3.00/lb, Mo - US$10.00/lb and Au - US$1,500/oz.

(2) The Warintza Mineral Resource estimate was reported in the “Resource Estimate Of The Warintza Central Cu-Mo Porphyry Deposit" prepared by Equity Exploration Consultants Ltd. with an effective date of December 13, 2019. The Warintza Central Mineral Resource statement has been prepared by Trevor Rabb, PGeo who is a qualified person as defined by NI 43-101. The resource is reported using a cut-off of 0.2% copper. Solaris defines copper equivalent calculation for reporting purposes only. Copper-equivalence calculated as: CuEq (%) = Cu (%) + 3.33 × Mo (%) + 0.73 × Au (g/t), utilizing metal prices of Cu - US$3.00/lb, Mo - US$10.00/lb and Au - US$1,500/oz. Mineral Resources are not Mineral Reserves and do not have demonstrated economic viability.

(3) No adjustments were made for recovery as the project is an early stage exploration project and metallurgical data to allow for estimation of recoveries is not yet available. Solaris defines copper equivalent calculation for reporting purposes only. Copper-equivalence calculated as: CuEq (%) = Cu (%) + 3.33 × Mo (%) + 0.73 × Au (g/t), utilizing metal prices of Cu - US$3.00/lb, Mo - US$10.00/lb and Au - US$1,500/oz.